Why You Should Get A Traded / Resale Endowment Policy (REPs) (TEPs) Instead of Starting A New One

Why are the Yields Higher With A Traded / Resale Endowment Policy (REPs) (TEPs)?

In the insurance market, a brand new endowment plan of 10 years typically has a yield of 2.5% P.A. Whereas a 10 years Traded / Resale Endowment Plan has a yield of 4% P.A. instead.

That’s a whopping 1.5% more!

How is that even possible when both plans are the same product from the same insurance company? Why is the interest so much higher with a Traded / Resale Endowment? Before we analyze the practical aspect of achieving higher yield from a Traded / Resale Endowment Plan, let us go through some endowment basics.

What exactly is an Endowment (participating policies)?

Endowment insurance products are often marketed as a savings plan to help you meet a specific financial goal, such as paying for your children’s education or building up a pool of savings over a fixed term. Participating endowment policies share in the profits of the company’s participating fund. Your share of profit is paid in the form of bonuses or dividends to your policy. Endowment policies have cash values that will build up after a minimum period, and this differs from product to product.

Growth Phases of an Endowment Policy

There are three growth phases in an endowment policy, namely the Slow Phase, Mid Phase and Fast Phase.

Slow Phase – This phase occurs during the first few years of the endowment policy. Due to the distribution costs applied, an endowment policy usually has zero cash value in the first two years. As a result, the early period growth of the policy is very limited, explaining why endowment policies are often sold at a minimum tenure of 10 years.

Mid Phase – This occurs when the endowment policy has been running for a few years, with bonuses declared and extra interest accumulated from the bonuses declared earlier. At this phase however, the policy might not have even breakeven yet.

Fast Phase – The fast phase occurs towards the last few years of the endowment policy. This is the period where higher bonuses are declared by the insurance companies as part of the contract.

Higher Yield with Traded / Resale Endowment Plans

When you take over a Traded / Resale Endowment Plan, you are instantly skipping the slow growth phase of the policy and jumping right into the mid or fast phase. During this process, you also do not have to absorb the distribution costs incurred in the event if you purchase a brand-new endowment plan.

Let’s take a look at an example.

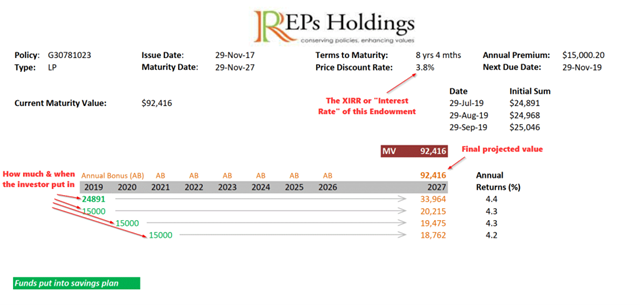

This policy was originally a 10-year endowment plan (29-Nov-17 to 29-Nov-27). The original owner of this policy sold it to us less than 2 years of holding it. The numbers in green show the cash flow that he/she will need to put in.

In this case, the new owner of this policy will need to fund $24,891, and (3 x $15,000 = $45,000). Do note that the premium for the first 2 years ($15,000 x 2 = $30,000) has already been paid for. When the new owner pays $24,891 to take over the policy in July 2019, there will be an immediate savings of almost $5000.

When the policy matures 8 years later in 2027, the policy will pay out $92,416. By skipping the distribution costs of the endowment policy and jumping right into the mid-phase, the new owner enjoys a higher yield of 3.8% P.A. for a period of 8 years.

And this is how you can enjoy higher, efficienc savings within a shorter time-frame by purchasing a Traded / Resale Endowment Policy!

Contact us today to find out more, or you could also take a look at our REPs List here.