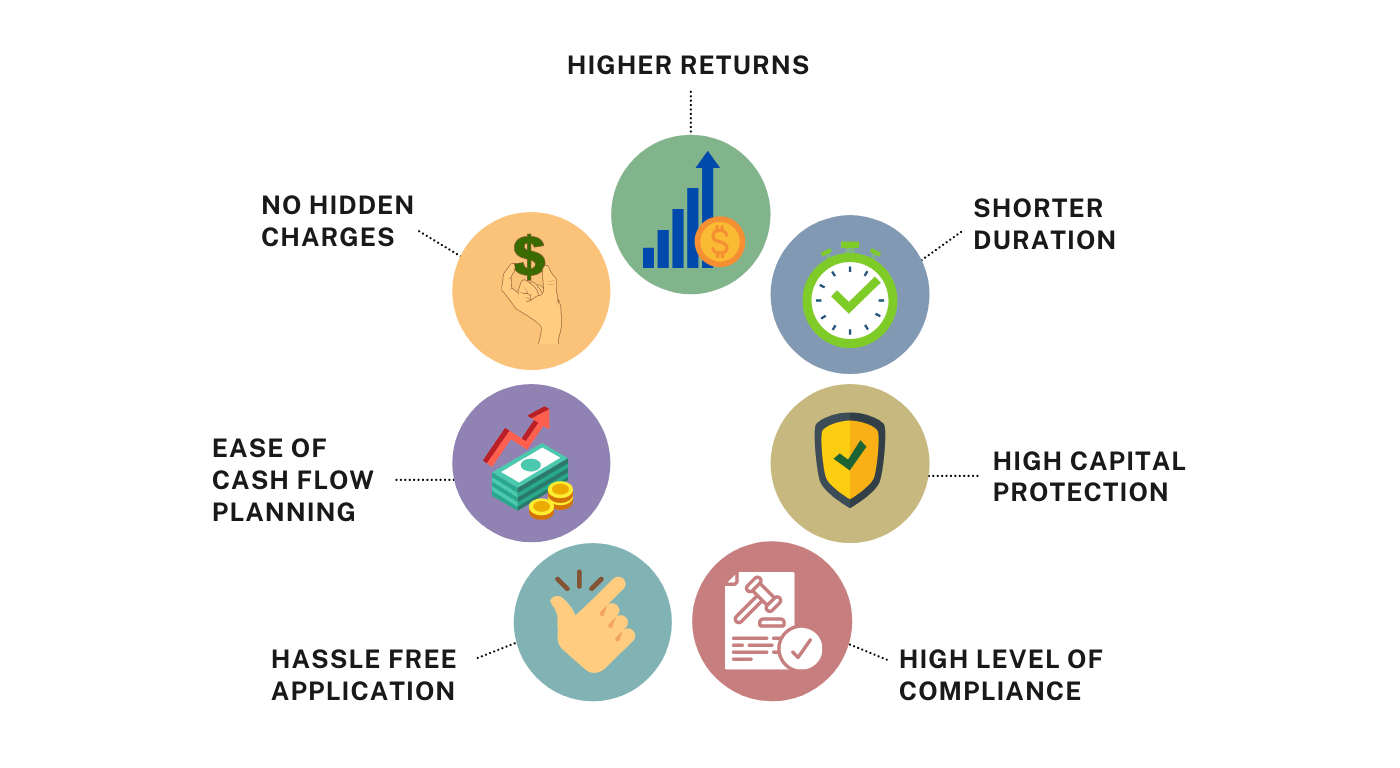

Benefits of REPs® or TEPs

Higher Returns

A REPs® or TEPs could give you double or more returns than a brand new endowment policy. Initial policy costs (commissions, policy fees) have been borne by the original policyholder.

Shorter Duration

You only need to continue the remaining duration of a REPs® / TEP which is usually less than 15 years.

High Capital Protection

REPs® / TEPs have been in force for years with accrued bonuses. Together with the basic sum assured, they form a high capital guaranteed portion.

High Level of Compliance

Our products are issued by MAS licensed insurers and are governed under strict regulations by the authority. They are also covered under the policy owners’ protection scheme by SDIC.

Hassle-Free Application

Anyone can take up a REPs® / TEP regardless of health status, age (at least 21 of age) and income. There are no requirements such as health checks or fact-finding.

Ease of Cash Flow Planning

You can choose from the flexible maturity period. Premiums and maturity payout are known and fixed on certain dates.

No Hidden Charges

You only pay for the purchase price (Initial Sum). There are no other fees or on-going charges involved.