Getting The Right Plan

Types of REPs / TEPs

There are mainly 3 types of Resale Endowment Policies or Traded Endowment Policies:

1. Regular Premium (RP)

An initial sum to take over the policy and regular annual premiums are made to the policy for the remaining term. Suitable for those with a regular future stream of income. RP has the highest wealth accumulation effect.

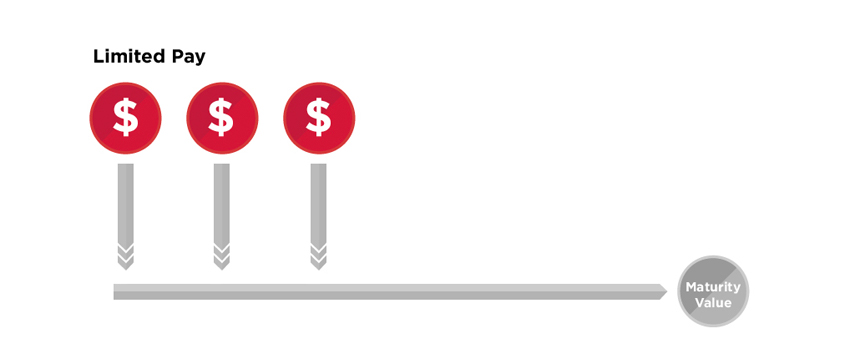

2. Limited Pay (LP) or Single Premium (SP)

An initial sum to take over the policy and annual premiums are made to the policy for part of the remaining term. Suitable for those who prefer a shorter period of premiums commitment.

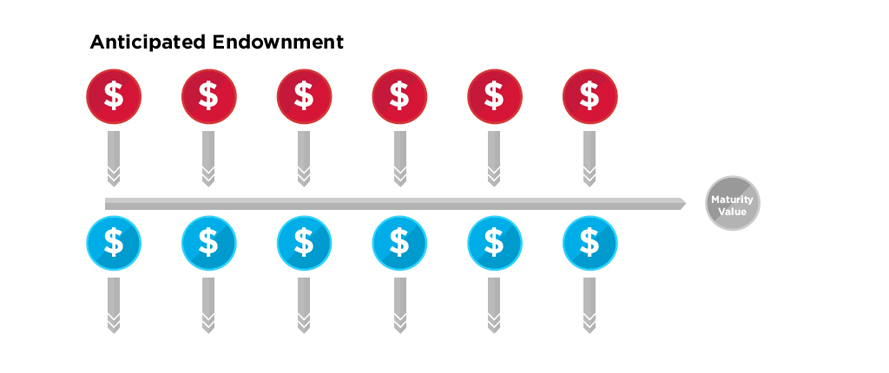

3. Anticipated(With Cashbacks) (AE)

An initial sum to take over the policy and regular annual premiums are made to the policy. AE comes with cash benefits component. It is suitable for those who prefers liquidity and flexibility. The cashbacks can act as emergency funds as they can be withdrawn any time if required.