How Traded / Resale Endowment Policies (REPs®) (TEPs) Work

How Traded / Resale Endowment Policies (REPs®) (TEPs) Work

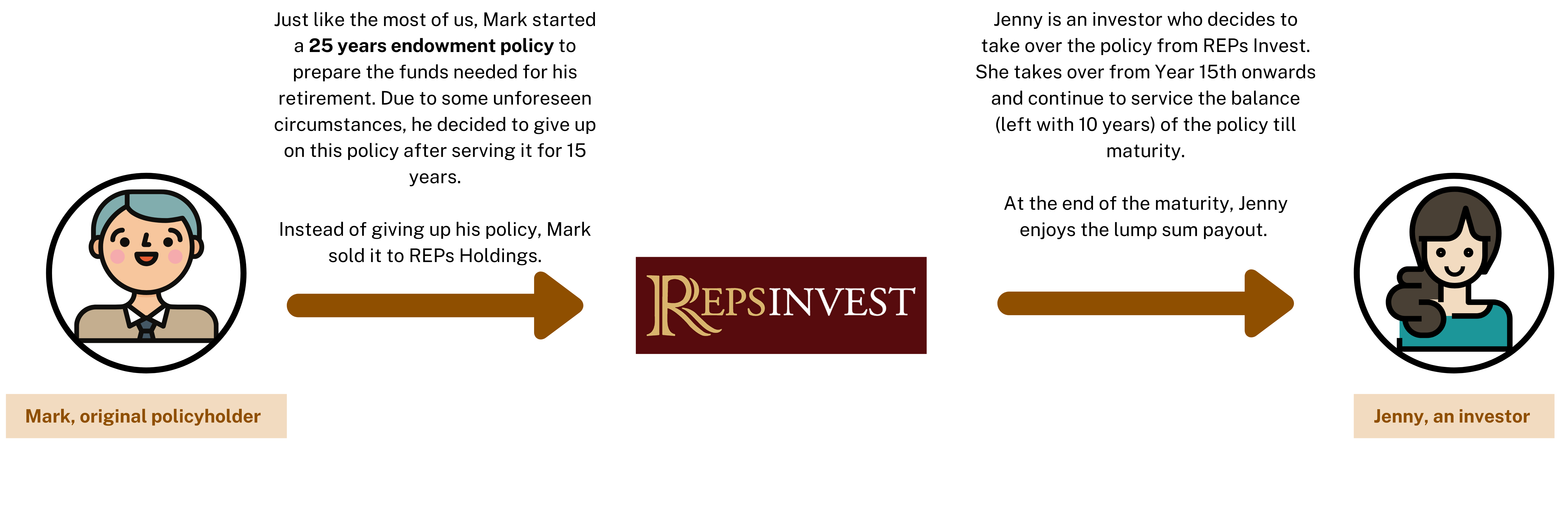

With the example above, Jenny would have taken over a policy with only 15 years remaining instead of a full 25 years tenure. She will have to save an initial sum to takeover the policy. This will provide greater value and a much shorter waiting period.

Higher Returns

- This 10 years REPs® / TEP can give you returns that could be double or more than that of new policy.

- The initial policy costs (commissions, policy fees, hidden charges) have been borne by the REPs Invest

- Cash values of endowment policies are structured to build up faster only in the later part of the policy

Shorter Duration

Instead of starting a new policy which can be 25 years long, you only need to continue the remaining terms of REP/TEP and in this case, is only less than half of the required duration.