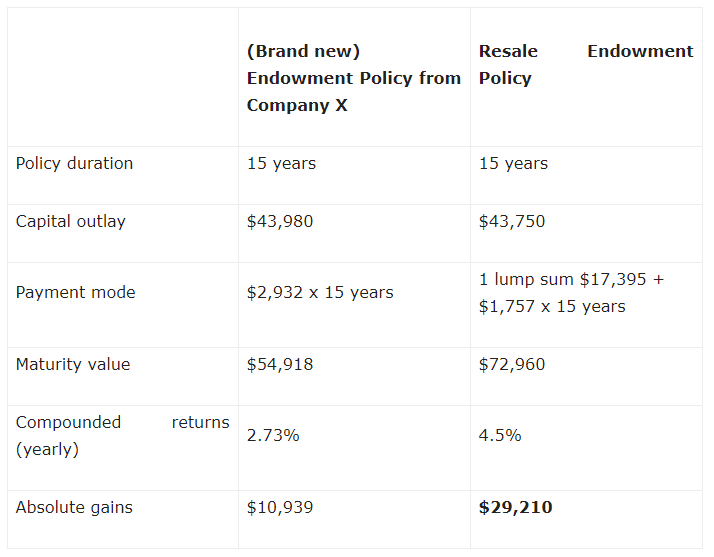

Traded / Resale v.s. New Endowment Policy

Why investing in traded / resale endowment policy is a wiser choice

Traded / Resale endowment policies (REPs) (TEPs) are policies sold by the original policy owner to a third party who buys it for investment purposes. The new owner will enjoy a significantly higher return (sometimes even double the returns) than what a new endowment policy will get in today’s market. More importantly, the new owner will only need to wait for as short as 1 year to see his investment matures. In this article, we will discuss in-depth the reason for the higher returns and shorter duration that REPs / TEPs offer over a new policy. The calculations used in the article are based on the fundamental principle of the time value of money (TMV). For readers who are not familiar with the concept, the TMV principle is to calculate the value of money at a particular point in time given the discount rate (or the annual investment return in our discussion).

The basic reason for the higher return in REPs / TEPs is that the investor is buying the policybelowthebook value (BV). In the first section, we will calculate the BV of a firsthand policy at the end of each policy year. In the following section, we calculate the investment return of a REPs / TEPs investor who took over the policy in the middle of the policy term.

Cost and return of a brand new policy

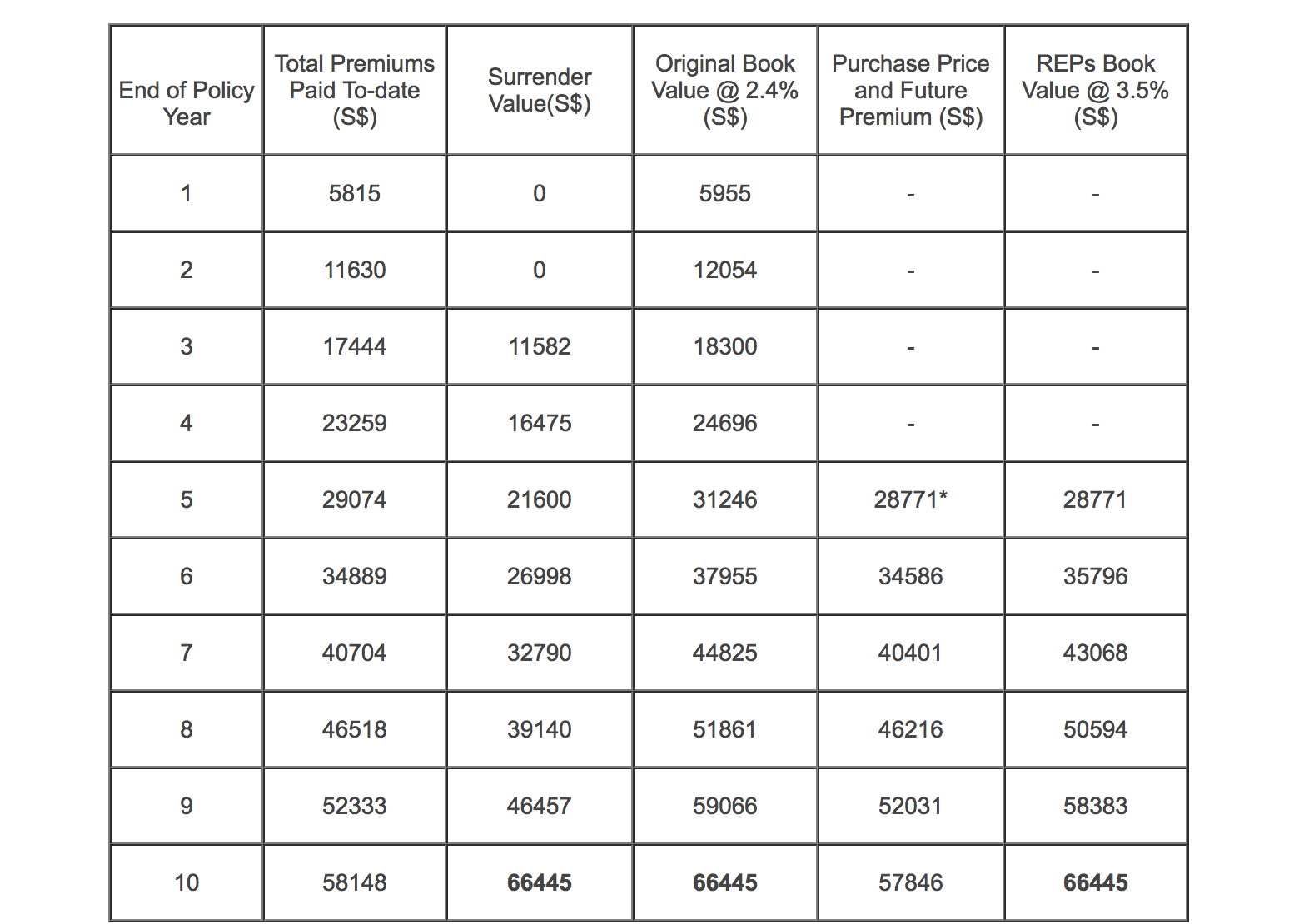

We will consider the case of a 10 years regular premium endowment policy. The total premium paid to-date figures shown in Table 1 are extracted from the policy benefits illustration. To summarize the annual premium is $5815 and the maturity sum is $66445 at the end of 10 years. The surrender value (SV) in the third column is the amount the insurance company pays the policy owner if the policy is terminated before maturity.

We calculate the investment return of the original owner assuming he paid the annual premium and held the policy to maturity. To determine the investment return we calculate the annual interest rate such that the sum of the yearly compounded premiums is equal to the maturity amount (For the technical inclined readers, the Excel command =RATE(10,5815,0,-66445,1) gives the rate of 2.41%). Next, the BV is computed by calculating the future value of all past premiums compounded at 2.41% to the end of each year and it is tabulated in the last column of Table 1.

We noted that the SV is substantially less than the total premium paid and SV because the policies' distribution cost (commissions and administrative fees) are paid from the first few years of premiums. If the policies traded hand at a price between the SV and BV, the new owner will achieve a return better than the 2.41% original returns. In the next section, we will examine the scenario where the REPs investor acquires the policy below the BV.

Table 1: The premium paid; surrender value (SV) and book value (BV) for a 10 years endowment policy. Note that the premium is paid at the beginning of each time period.

Investment returns for REPs / TEPs investor

Consider the scenario in which the REPs / TEPs investor takes over the policy at the end of year 5 for an initial sum of $28771 (at below the year 5 BV of $31246). The investor will also be responsible for the remaining 5 years of annual premium. Using the TVM formula in Excel, we calculate the investor’s annualized return to be 3.50% (=RATE(5,5815,28771,-66445,1)) which is 1.09% higher than the original policy return of 2.41%. One interesting thing to note is that the REPs / TEPs purchase price is even lower than the total premiums paid over the first 5 years by the original owner, thus ensuring that the REPs / TEPs investor will always outperform someone who bought a brand new policy. We calculated the REPs policy value by taking the initial purchase price and future premiums (which is the investor’s responsibility) and compounding them at 3.50%. The numbers are tabulated in the last 2 columns of Table 2. Due to the higher compounding rate the REPs / TEPs investors get a higher return from the same underlying endowment policies!

Table 2: Comparison of the returns of the REPs / TEPs investor and the original policy owner

* The amount is invested on the last day of policy ending year 5. Therefore the book value is equal to the initial investment sum as the effective compounding period is 0.

We have shown that an investment in REPs / TEPs is a good choice if you are considering buying into an endowment policy. The returns are higher and the duration can be selected to meet the investors’ particular financial requirements. Start planning for your financial future now by taking action now.